BTC Price Prediction: 2025-2040 Outlook Amidst Volatility and Institutional Adoption

#BTC

- Technical Divergence: Price sits above 20-day MA but MACD shows bearish momentum

- Macro Tensions: IMF scrutiny contrasts with traditional finance integration

- Price Discovery: $123K remains key resistance amid miner selling pressure

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Consolidation

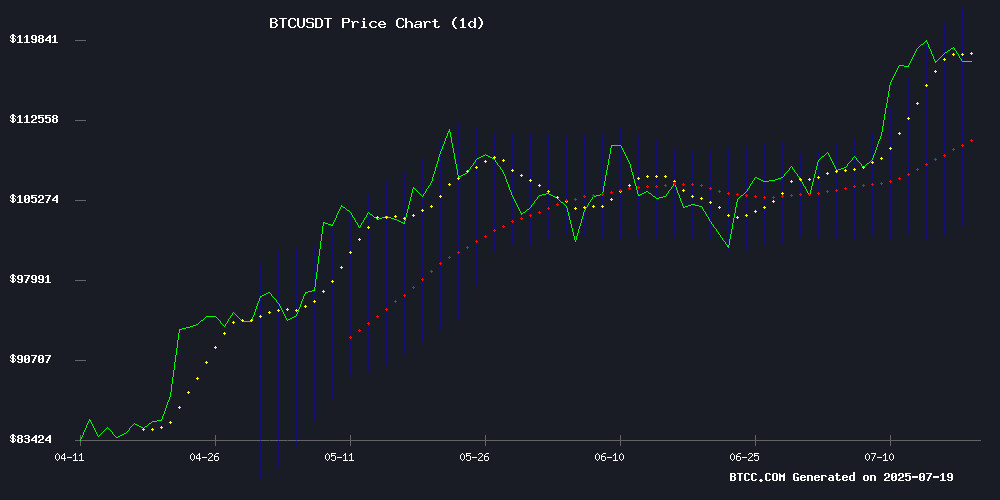

BTC is currently trading at $117,480.70, above its 20-day moving average (MA) of $113,296.26, suggesting a bullish bias in the NEAR term. However, the MACD indicator remains negative at -5,730.11, signaling potential bearish momentum. Bollinger Bands show the price hovering near the upper band at $123,191.21, indicating overbought conditions. BTCC financial analyst Olivia notes, 'While BTC holds above the 20-day MA, the MACD divergence and proximity to the upper Bollinger Band suggest a possible pullback to test support at $113K.'

Market Sentiment Mixed as Bitcoin Faces Macro and Technical Headwinds

Recent headlines reveal conflicting forces impacting BTC: The IMF's allegations against El Salvador's Bitcoin purchases and bearish rejection at $120K contrast with institutional adoption (Block joining S&P 500) and record miner sales. BTCC's Olivia observes, 'The market is digesting multiple narratives - regulatory scrutiny versus traditional finance integration. The failed breakout above $123K aligns with our technical resistance view, but trillion-dollar market cap growth shows underlying strength.'

Factors Influencing BTC's Price

IMF Report Reveals El Salvador's Bitcoin Purchases Were Illusory in 2025

El Salvador's much-publicized daily Bitcoin purchases under President Nayib Bukele appear to have been an accounting illusion, according to a bombshell IMF report. The National Bitcoin Office had claimed continuous accumulation throughout 2025, with public trackers showing holdings exceeding 6,102 BTC.

The IMF's Article IV consultation reveals no new purchases occurred after December 2024's $1.4 billion Extended Fund Facility approval. Wallet movements between government-controlled addresses created the false impression of market activity. This revelation comes with IMF footnote #9 explicitly stating purchases were halted as a loan condition, with only internal wallet consolidation occurring.

The disclosure reignites debate about El Salvador's pioneering 2021 Bitcoin legal tender law, which reports suggest may have been quietly reversed. Market observers note the IMF's intervention highlights ongoing tension between cryptocurrency adoption and traditional financial oversight.

Bitcoin ETFs Boom as Self-Custody Growth Hits 15-Year Low

The US spot bitcoin ETF market continues its record-breaking rally, with BlackRock's iShares Bitcoin Trust (IBIT) surpassing $80 billion in assets under management—the fastest ETF to reach this milestone. This institutional embrace marks a pivotal shift in crypto investment behavior.

On-chain data reveals a striking trend reversal: the growth rate of self-custody Bitcoin users has declined for the first time in 15 years. Analyst Willy WOO attributes this to ETF adoption, as measured by Glassnode's Entities Net Growth metric tracking forensic user clusters rather than raw addresses.

The divergence between ETF-driven institutional participation and retail self-custody raises fundamental questions about Bitcoin's decentralization ethos. While ETFs provide mainstream access, they centralize custody—a tradeoff that's reshaping the cryptocurrency's investor base.

IMF Accuses El Salvador of Misrepresenting Bitcoin Purchases

The International Monetary Fund has challenged El Salvador's claims of continuous Bitcoin acquisitions, revealing the Central American nation hasn't bought BTC since December 2023. Government wallet reshuffling created the illusion of new purchases.

Internal transfers between El Salvador's Strategic Bitcoin Reserve Fund and Chivo e-wallet accounted for perceived increases in holdings. The IMF's first review of its $1.4 billion Extended Fund Facility arrangement found no change in the country's public Bitcoin reserves since program approval.

While Chivo wallet balances showed minor fluctuations from user activity, these movements didn't represent new state-sponsored BTC accumulation. The disclosure undermines El Salvador's highly publicized daily Bitcoin acquisition strategy promoted through official social media channels.

Bitcoin Faces Bearish Rejection at $120K, Analyst Warns of Pullback to $113K

Bitcoin's rally to a record $122,838 on July 14 has lost momentum, with prices now consolidating between $117,000 and $118,500. The abrupt rejection from the $120,000 resistance zone signals potential downside, according to technical analyst Melikatrader94.

A Quasimodo Level (QML) pattern on hourly charts suggests Bitcoin could retreat to $113,600. The failed breakout attempt above $119,000 triggered swift selling pressure, erasing earlier gains that had absorbed key support levels. Market sentiment appears to be shifting as traders digest the possibility of deeper corrections.

Altcoins may face amplified volatility if Bitcoin's dominance reasserts itself during this consolidation phase. The market's next directional MOVE hinges on whether bulls can defend the $116,000 support zone or if bears push toward the analyst's $113,000 target.

Bitcoin's Failed Ascent Past $123,000: Analyst Points to Key On-Chain Resistance

Bitcoin's rally to a record $122,800 last week faltered just shy of the $123,370 Alpha Price level—a critical on-chain resistance threshold identified by Alphractal CEO Joao Wedson. The rejection at this technical barrier, compounded by a Satoshi-era whale's recent transaction, suggests near-term bearish pressure for the dominant cryptocurrency.

Market observers now question whether BTC can maintain momentum toward Wedson's $143,000 projection. The Alpha Price metric, which analyzes blockchain data to identify cyclical turning points, implies that sustained trading above $123,370 WOULD signal the next bullish phase. Until then, the market remains in a consolidation pattern following its historic climb.

Block Joins S&P 500, Marking a Milestone for Crypto in Traditional Finance

Block, the fintech firm formerly known as Square, has been added to the S&P 500, replacing Hess Corporation following its acquisition by Chevron. The move, confirmed by S&P Dow Jones Indices on July 18, underscores Block's evolution from a payment services provider to a key player in cryptocurrency infrastructure.

The company's integration of Bitcoin through Cash App and its corporate treasury has positioned it at the forefront of digital asset adoption. Block now becomes the second crypto-aligned firm in the S&P 500 after Coinbase, further bridging the gap between traditional finance and the emerging crypto economy.

Inclusion in the benchmark index reflects Block's compliance with stringent criteria, including profitability, market capitalization, and liquidity. The development signals growing institutional acceptance of cryptocurrency, with Block joining Coinbase and Tesla as S&P 500 constituents holding direct Bitcoin exposure.

Bitcoin's Decoupling from Altcoins Signals Market Volatility Ahead

Bitcoin's recent divergence from altcoins may foreshadow heightened market turbulence, according to on-chain analyst Joao Wedson. Alphractal's founder warns of a potential BTC price drop within 24 hours based on three key metrics showing excessive long positions and decoupling trends.

The Correlation Heatmap between BTC and altcoins reveals an unusual breakdown in their typical price relationship. Such decoupling events historically precede volatile price action across crypto markets, with altcoins particularly vulnerable to sudden sentiment shifts.

Market participants should monitor the Altcoin Season Index for confirmation of this trend. When altcoins stop mirroring Bitcoin's movements, it often signals either impending sector rotation or broad market corrections.

Bitcoin Miner Sales Surge to Highest Level Since April as BTC Hits All-Time High

Bitcoin miners are cashing in on the cryptocurrency's record-breaking rally. Fresh data from CryptoQuant shows miner outflows spiked to 16,000 BTC on July 15—the highest daily level since April—as Bitcoin touched an all-time high NEAR $123,000. Nearly all of those coins went directly to exchanges.

The sell-off signals a potential shift in sentiment among large holders. Exchange inflows from miners and whales surged from 19,000 BTC to 81,000 BTC on the day of the price peak, creating short-term supply pressure. While the broader uptrend remains intact, with Bitcoin holding above $115,000, momentum has slowed as traders reassess positions.

Market veterans recognize this pattern: rapid price appreciation followed by miner profit-taking often precedes consolidation. Whether this develops into a deeper correction or merely a healthy reset will become clear in coming sessions. The underlying fundamentals—particularly strong long-term holder activity—continue to support bullish structural trends.

Bitcoin's Trillion-Dollar Surge Outpaces Traditional Markets

Bitcoin's valuation has entered uncharted territory, breaching $123,000 this week to set a new all-time high. The cryptocurrency's 13% monthly gain dwarfs the S&P 500's 4.73% return, delivering annual-equivalent stock market performance in just seven days.

The asset's correlation with equities has tightened dramatically, swinging from negative to 72% positive within weeks. Yet Bitcoin continues to outperform, buoyed by its smaller market cap and earlier position on the adoption curve compared to blue-chip stocks.

Market capitalization tells the story of exponential growth: reaching $2.34 trillion required just six weeks to add another trillion dollars after hitting $1.34 trillion in late May. This acceleration suggests institutional capital is flowing into digital assets at unprecedented scale.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

While precise long-term predictions are challenging, BTCC's Olivia provides this framework based on current technicals and adoption trends:

| Year | Conservative Estimate | Bull Case Scenario | Key Drivers |

|---|---|---|---|

| 2025 | $90K-$130K | $150K+ | ETF flows, halving aftermath |

| 2030 | $250K-$400K | $600K+ | Institutional adoption, scarcity premium |

| 2035 | $500K-$800K | $1.2M+ | Global reserve asset status |

| 2040 | $1M-$2M | $3M+ | Network effect maturity |

Note: These projections assume no black swan events and continued technological development.